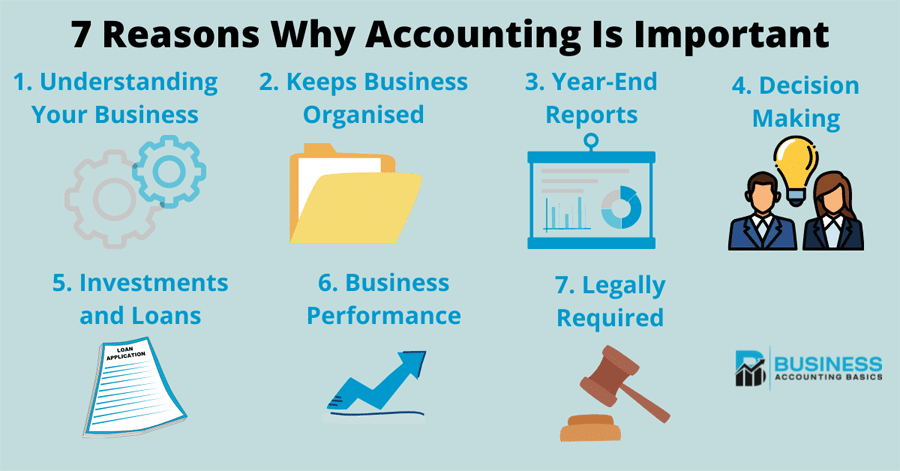

Services

What We do

Small Business Accounting

1.Transaction Review:

- Categorization:This is considered the initial step of the process, which is the classification of all expenses and deposits to the proper category or Account in the Chart of Accounts.

- Uncategorized Expense / income: This usually refers to checks sent out or any item that we couldn’t define from the imported bank details. We always make sure these items are categorized to the proper category.

- Transaction without payee: Each transaction has to have its own payee defined. No matter what the dollar amount is. This will allow Business owners to track their expenses by Vendor.

- Undeposited Funds: We clear all the payments received and deposited for the month. This will allow the Business owner to know the true value of his total Revenue

- Unapplied Payments: in this section we will review any payment that was not received properly( Either wrong invoice. Date …etc). This allow to have an accurate balance for each customer.

- Additional items

- Review all and any Personal transaction.

- Review loan payments

- Record any cash transaction paid from the cash register or by owners.

2.Account Reconciliation:

A bank account reconciliation is the process of matching the balances in your Business “Accounting Records” against the statements issued by your financial institution, or any other source documents. By having us reconcile your accounts each month allows you to:

- Identify unpaid Checks, lost checks to deposit.

- Identify unauthorized bank charges and ensures the accuracy of the bank classifications (Ensure all transactions are posted properly).

- Identify and prevent fraudulent transactions from or within your company.

- Know how your business is doing? You can’t really know unless all accounts are reconciled and properly accounted for on your financial statement.

- Manage your cash more efficiently. Proper management of funds not only saves money, but makes your money work for you.

- Protect yourself. By timely reconciling and promptly complaining to your bank about any unauthorized, fraudulent, or falsified checks presented to your bank and paid from your account, you can relieve your agency of responsibility for the shortfall and transfer the risk to the bank.

- Have the peace of mind: You will sleep better at night knowing your bank accounts are fully reconciled, in balance and all escrow funds, accounts, checks and disbursed funds are properly recorded.

a. In this section we reconcile all Balance sheet accounts but owner’s equity ( we still review the accounts with our Client to teach Best practices).

b.Bank Accounts and Credit cards : these will be reconciled to the statement issued by your financial institution.

c.Note Payable and Loans: these will be reconciled to the statement issued by the blender or any reimbursement amortization schedule.

d.Payroll liability: These must be reconciled to the report issued by the payroll provider for each pay period.

e.Sales Tax: This will be reconciled to the report filed to the state office . CreAccount Reconciliation: Business Checking, Credit Card, Line of Credits and Merchant account Services.

3. Company’s Financial Statements

Financial statements are written records that convey the business activities and the financial performance of a company. Financial statements are the reports often audited by government agencies, accountants, firms, etc. to ensure accuracy and for tax, financing, or investing purposes. Financial statements includes:

- Balance Sheet: The term balance sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.

- Income Statement: The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. The income statement is the first financial statement typically prepared during the accounting cycle because the net income or loss must be calculated and carried over to the statement of owner’s equity before other financial statements can be prepared.

- Cash Flow Statement: A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.

4. General ledger Review and Cleaning:

The general ledger is the core of your company’s financial records. These records constitute the central “books” of your system. Since every transaction flows through the general ledger, a problem with your general ledger throws off all your books.

Having us review your general ledger system each month allows us to hunt down any discrepancies such as double billings or any unrecorded payments. Then we’ll fix the discrepancies so your books are always accurate and kept in tip top shape.

5.Consultations:

This item is part of the Bookkeeping Service that we provide on monthly basis tasks, which is a solid base of your small business accounting system. You can customize the package of services you receive by adding payroll, tax preparation, or any of our other services.

Tax Services

Our Practice is partnered with one of the best CPA in the region, ATSV Consulting & Tax Services, Lead by Mrs. Angie Santos to cover the Following Items:

Tax Filing : Business & Individual Tax Return Filing .

Business Consulting: This will help to set up your Business properly by filing the right entity that fits you business type and income, and keep you in compliance with the State and federal regulations

If you need immediate attention with this item you can schedule your session with our CPA by following these Link .

Payroll

We provide payroll solutions that fit your business needs. We will help set the best payroll system and will educate you to Run it by yourself or you have us run it for you, which will help you have more time to focus on the Business development.

Public Notary

This is an add on that we offer to take away the burden of finding a place to certify your signature or copies. This will save you time to focus on business development.

Free Estimation

Give us a call

for any concerns